I decided to try out the cash-based budgeting system for the month of May. I was really excited about it, especially with the prospect of saving money, but I was also a bit anxious to see how easy (or hard) it would be to operate on a cash-based budget.

Initial worries: do people even take cash anymore? (They do!) What if I need to buy something online? I don’t want to carry cash around everywhere… I’ve never withdrawn this much cash from the bank before! I have trouble tracking my card transactions, will I be able to keep up with this system??

The plan:

- I get paid once a month, so I create a monthly budget using the Ultimate Budget by Paycheck by JRen Digital on Etsy

- Budget out my bills, savings ($1,500/check is my current goal), and subscriptions to keep in my bank account. Then I take what’s left and divvy it amongst my variable/non-essential expenses. That money is what I will take out of my bank account.

- Withdraw the money that I allocated for my variable expenses, with the denominations broken down with a denominations sheet for the teller. Once I have the cash, I split it up into each category in my cash budgeting wallet.

- Each time I spend money, I keep the receipt and enter the transaction into my Ultimate Budget tracker, which automatically calculates how much money I have left for each category once I spend money. I also have a paper balance sheet that I can use to write transactions down, but have found that I don’t need this step since I have the digital tracker.

Reflections from the month:

+ much easier than I thought it’d be to manage

– messed up the first transaction I had, didn’t take money out of proper categories so the exact cash balances were off to start the month off… ended up not being a huge deal but it stressed me out lol

-/+ When places didn’t take cash/I was in a rush, I ended up using my credit card to pay and put away cash to deposit to essentially pay that money back. It’s not the most convenient process, but I think part of the point of this cash-based budgeting system is not to be so convenient, because convenience is what leads to mindless spending in the first place. So I actually like that this forces me to slow down and think about how I’m spending my money before I spend it.

+ Saving change is SO FUN to me lmfao, this is probably my favorite part of using cash. I round all of my transactions up on my tracker, treating change as if it’s been ‘spent’. Then, I take the change and use it for my change savings challenge.

+/- Initially I felt really weird about pulling cash out to pay everywhere, but the more I did it and people didn’t look at me crazy or bat an eye, the more I realized.. this is perfectly normal lol. This is how people have been spending money since money’s been a thing! And lowkey I like cash transactions.

+ removing my card from my phone and Apple Pay and things like that really kept me in check lol. I would want to grab a last minute snack from the vending machine or something, realize I needed to go grab cash because I couldn’t use my phone, and ended up deciding that I didn’t need the snack anyway lmfao.

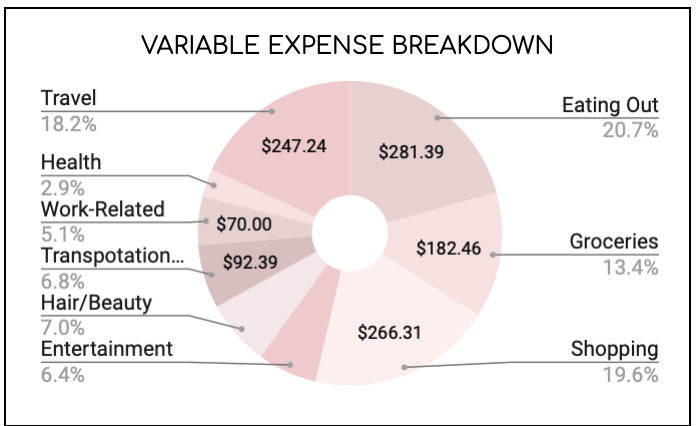

– Since my categories got fuddled early on in the month, I ended up depositing all of my cash back into my bank account to consolidate it all and ‘reorganize’ in a way. That, coupled with an event that I hadn’t planned for,(and eating out WAY TOO MUCH!) lead to me overspending a tad…. Which lowkey sucks because I did really great up until that last week. Fortunately, though, I put my savings away first, so I still met my savings goal.

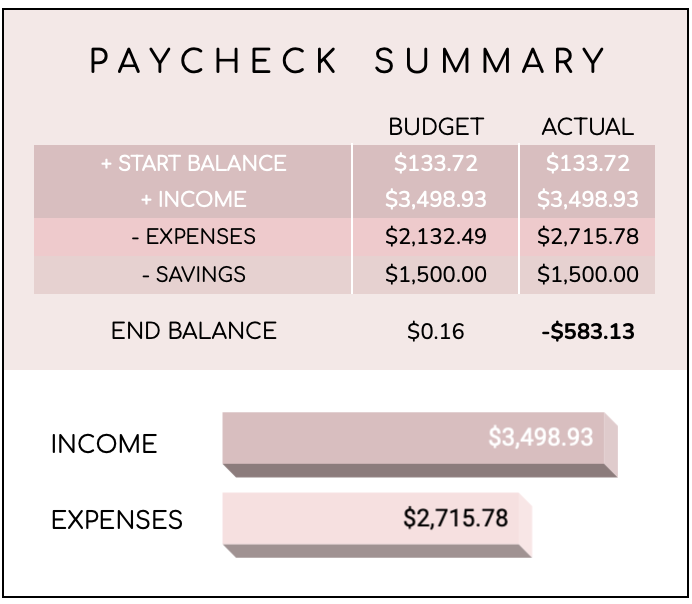

Results of the month:

- Savings Goal: $1,500

- MET! Saved $1,500 upfront because I believe in #payingmyselffirst

- Budget results:

Thoughts, goals, etc. for next time… Since I’m a teacher and won’t be receiving a normal paycheck for the rest of the summer, I don’t know how comfortable I feel saving such a large amount of money or doing the cash-based system, just because there’s a lot of variability going on while I’m on summer break. I plan on doing a little bit of traveling and I absolutely do NOT want to travel with cash. When the school year starts again, though, I can definitely see myself trying this out again. I think it forced me to slow down and think about my purchases, which ultimately helped me curb my spending and save money! Next time, though, I’ll definitely have to pay more attention to which money category I’m pulling from, and be more intentional about my online buys. I think my next money challenge may be a no-spend week or month?.. More on that later…